(AFP) – United States Steel warned Wednesday it could shut its headquarters and factories in Pennsylvania, a key swing state in November’s election, if a takeover by Japan’s Nippon Steel is blocked. At a rally in downtown Pittsburgh, backers of the deal touted the transaction as a lifeline to one of western Pennsylvania’s defining industries.

But shares of US Steel sank almost 17.5 percent following a Washington Post report that President Joe Biden plans to block the deal. Bloomberg News quoted unnamed sources with the same information. In December, US Steel sealed a $14.9 billion agreement to sell itself to Nippon, which has promised investments to keep Pennsylvania factories competitive and newer “mini mills” in the American South.

However, the transaction has faced an avalanche of political opposition following its condemnation by the United Steelworkers (USW) union, which on Wednesday dismissed the Pittsburgh rally as an “increasingly desperate” gambit. The company laid out what Chief Executive David Burritt described as “unavoidable” negative consequences for the Pittsburgh region if the deal is killed.

“Without the Nippon Steel transaction, US Steel will largely pivot away from its blast furnace facilities, putting thousands of good-paying union jobs at risk,” the company said in a statement. “The lack of a deal with Nippon Steel raises serious questions about US Steel remaining headquartered in Pittsburgh,” it added.

On Monday, at a Labor Day election campaign event in Pittsburgh, Vice President Kamala Harris mirrored Biden’s stance, declaring that US Steel “should remain American-owned and American-operated.” Former president Donald Trump has also vowed to block the deal, while his running mate J.D. Vance has led congressional opposition to the takeover, describing domestic steel production as a national security priority.

Pennsylvania is one of a handful of states that will decide the election on November 5, and is possibly the one on which the whole result will hinge. The deal faces a review by the Committee on Foreign Investment in the United States, an interagency body established to review foreign takeovers of US firms.

CFIUS “hasn’t transmitted a recommendation to the President, and that’s the next step in this process,” a White House official said.

US Steel has argued that the Nippon deal is needed to ensure sufficient investment in its Mon Valley plants in Pennsylvania, the earliest of which dates to 1875. Nippon has promised to upgrade the plants, while also keeping US Steel’s 1,000-worker office in downtown Pittsburgh.

To make its case, Nippon has sent executives to Pittsburgh to meet officials and workers, while engaging with Washington powerbrokers by hiring Trump’s former secretary of state, Mike Pompeo, to lobby its case. On August 28, Nippon announced additional pledges to invest in Mon Valley to ensure it “operates for decades to come” and sustains “future generations of steelworkers in Pennsylvania.” Total planned Nippon investments in USW-represented sites amount to more than $2.7 billion, US Steel said.

Nippon said Thursday that it was “aware” of the media reports about Biden potentially blocking the takeover, calling on the US government to “appropriately handle procedures… in accordance with the law.” “US Steel and the entire American steel industry will be on much stronger footing because of Nippon Steel’s investment in US Steel — an investment that Nippon Steel is the only willing and able party to do so,” a statement said.

Nippon’s shares rose 1.3 percent in Tokyo trade on Thursday morning.

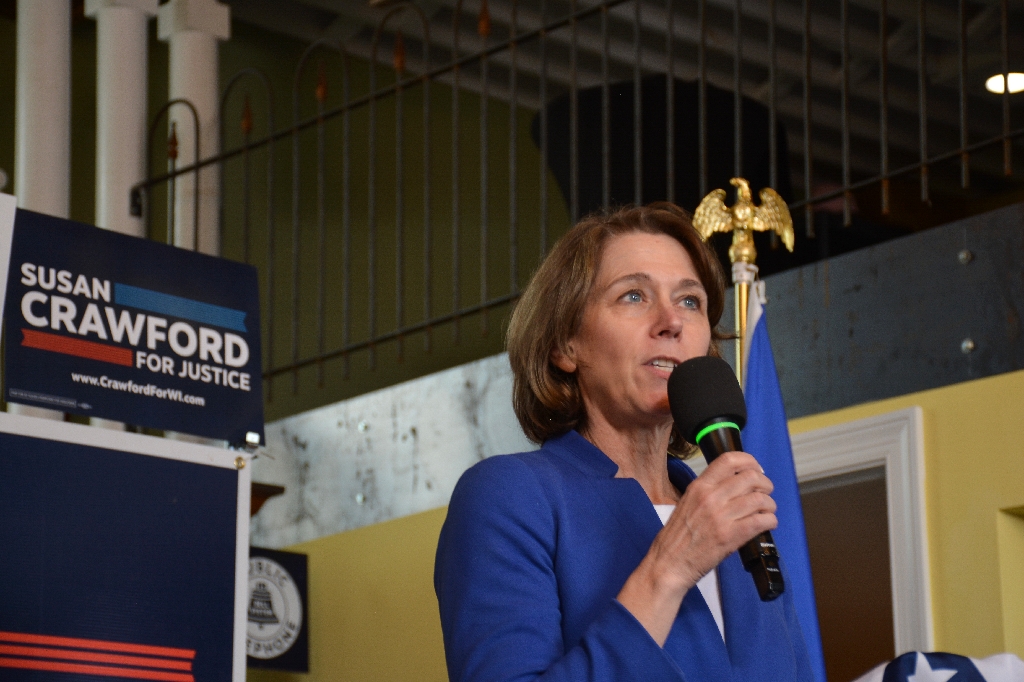

Speakers at the rally held outside the US Steel building in downtown Pittsburgh included workers and local politicians who emphasized that the plants were vulnerable to closure without the deal and noted that Japan is a US ally. Mark Yezovich, a 15-year US Steel employee whose uncle worked for the company for 45 years, said the deal was crucial to ensuring “US Steel will be around for another 100 years and allow future generations to follow in our footsteps.”

But the USW, which has described Nippon’s pledges as “worthless,” dismissed US Steel’s threats Wednesday as “baseless and unlawful.” The USW argues the deal is the result of mismanagement and underinvestment under Burritt and other US executives who would be “enriched” by the transaction.

“The merger sells out the future for workers, retirees, and communities and jeopardizes our nation’s ability to produce the melted, poured and finished steel products that we need for our national defense and critical supply chains,” the USW said.

The Mon Valley plants are the last steel factories in the Pittsburgh region following closures and mass layoffs in the 1970s and 1980s. The plants still account for around 3,000 USW-represented jobs in Pennsylvania. The total employment impact is more than 11,400 workers throughout the supply chain, with an estimated $3.6 billion economic impact, US Steel said.

– Rebecca DROKE with John BIERS in New York.

© 2024 AFP